Life Insurance in and around San Angelo

Insurance that helps life's moments move on

Life happens. Don't wait.

Would you like to create a personalized life quote?

- Abilene, TX

- Sweetwater, TX

- Big Spring, TX

- Brownwood, TX

- Snyder, TX

- Midland, TX

- Odessa, TX

- Fredericksburg, TX

- Kerrville, TX

- Lamesa, TX

- Andrews, TX

- Stephenville, TX

- Del Rio, TX

- Copperas Cove, TX

- Lubbock, TX

State Farm Offers Life Insurance Options, Too

One of the greatest ways you can protect your family is by taking the steps to be prepared. As pained as considering this may make you feel, it's a good idea to make sure you have life insurance to prepare for the unexpected.

Insurance that helps life's moments move on

Life happens. Don't wait.

Why San Angelo Chooses State Farm

Having the right life insurance coverage can help loss be a bit less complicated for the people you're closest to and allow time to grieve. It can also help cover important living expenses like car payments, childcare costs and retirement contributions.

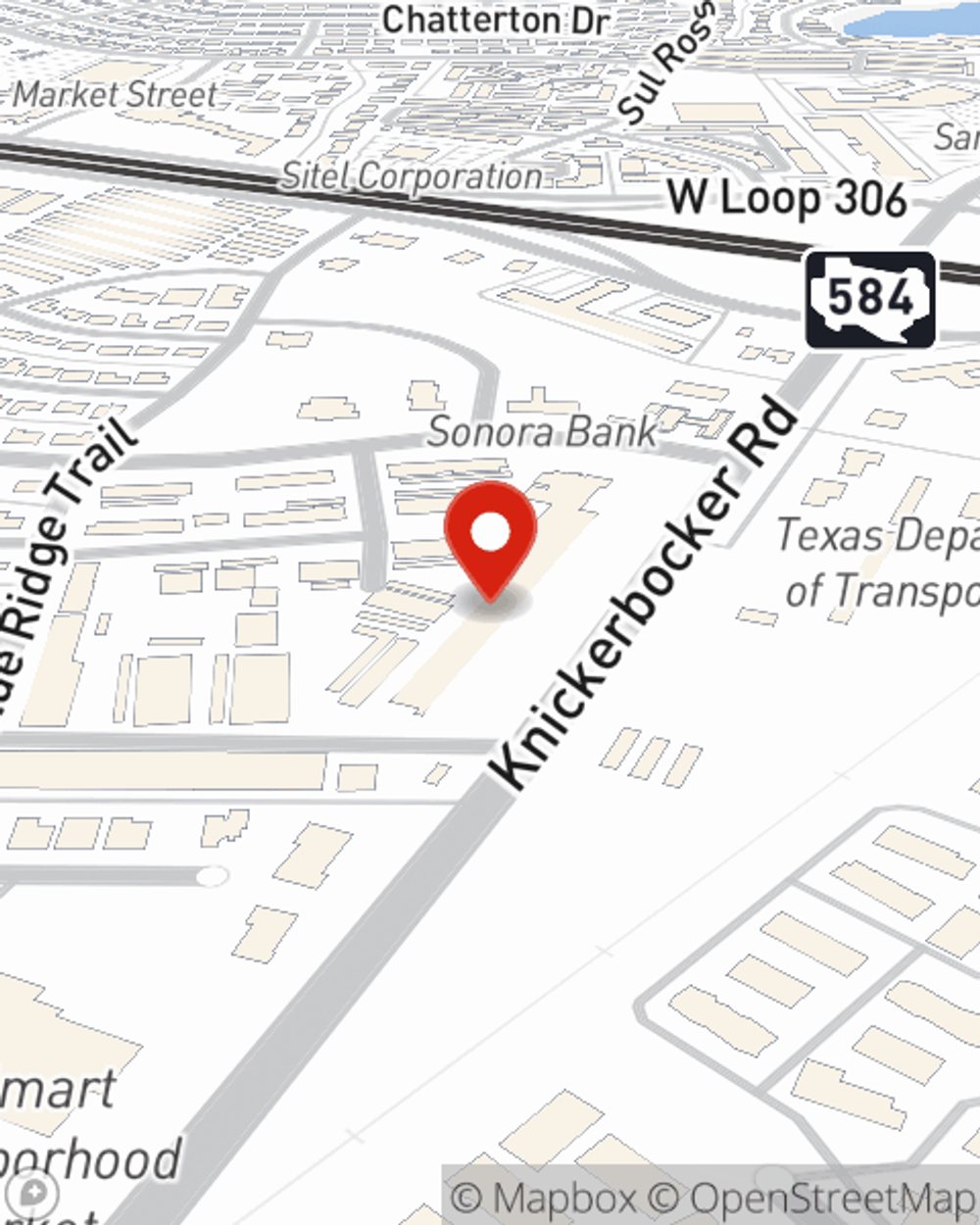

When you and your family are insured by State Farm, you might sleep well at night knowing that even if something bad does happen, your loved ones may be covered. Call or go online now and see how State Farm agent Greg Bratcher can help meet your life insurance needs.

Have More Questions About Life Insurance?

Call Greg at (325) 223-2222 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Benefits of owning a life insurance policy to cover your final expenses

Benefits of owning a life insurance policy to cover your final expenses

Final expense insurance (or burial insurance) can help relieve the burden of funeral planning. We'll explore details of guaranteed issue life insurance.

What determines the cost of life insurance?

What determines the cost of life insurance?

How do life insurance companies determine rates? And who pays more for life insurance? We break it down.

Life insurance basics

Life insurance basics

Understanding life insurance, what it is, how it works and the different types can help you decide which life insurance policy is right for you.

What happens when term life insurance expires?

What happens when term life insurance expires?

Understand your options before your level term life insurance policy becomes annually renewable causing your premiums to increase.

Greg Bratcher

State Farm® Insurance AgentSimple Insights®

Benefits of owning a life insurance policy to cover your final expenses

Benefits of owning a life insurance policy to cover your final expenses

Final expense insurance (or burial insurance) can help relieve the burden of funeral planning. We'll explore details of guaranteed issue life insurance.

What determines the cost of life insurance?

What determines the cost of life insurance?

How do life insurance companies determine rates? And who pays more for life insurance? We break it down.

Life insurance basics

Life insurance basics

Understanding life insurance, what it is, how it works and the different types can help you decide which life insurance policy is right for you.

What happens when term life insurance expires?

What happens when term life insurance expires?

Understand your options before your level term life insurance policy becomes annually renewable causing your premiums to increase.